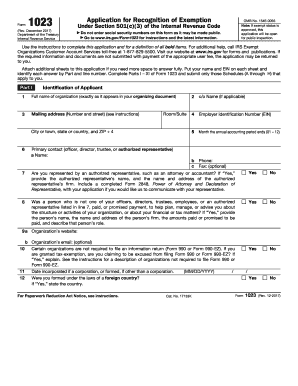

Who needs an IRS 1023 Form?

An IRS 1023 Form, which is the more common name for the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is used by charity organizations qualified as corporations, unincorporated associations or trusts. This organization may fall into such categories: religious, educational, charitable, scientific, literary, the ones aimed to test public safety, or to foster national or international amateur sports competition, or prevent cruelty to children or animals.

What is IRS 1023 Form for?

Organizations, having legal ground to apply for recognition of exempt status (or 501(c)(3) status) by the IRS, file Form 1023 to carry out this task. In the case of the IRS’s favorable decision, the organization will be exempted from the federal income tax and will be referred to as a non-profit association.

Is IRS 1023 Form accompanied by other forms?

The completed 1023 form is typically supported by some additional documentation. This can be: organizing documents, like articles of incorporation, bylaws, description of the organization’s activities, financial information, and a user fee.

When is IRS 1023 Form due?

An organization must apply for its exemption status and file 1023 within 27 months from the end of the month of its formation so that its exemption may be dated back to that month. If this requirement is not met the exemption will come into force from the filing date.

How do I fill out IRS 1023 Form?

The 1023 form must provide a very in-depth picture of what the activities of the organization are and how it functions. Therefore, some necessary provisions should answer the question as for the applicant’s identification, organizational structure, a description of the organization’s activity, information on employee relationship and financial arrangements with them, etc.

Where do I send IRS 1023 Form?

The filled out Form 1023 along with the supporting documentation should be mailed to the IRS office’s address as stated in the Instruction section.